True Liquidity [Fund Grade]

- Sandra Wakefield

- Dec 19, 2025

- 3 min read

True Liquidity [Plazo Sullivan Roche Capital]

What it is

True Liquidity maps where real business keeps happening (volume shelves / POC / value area), then waits for the institutional sequence:Liquidity sweep → confirmation → reclaim → continuation, filtered by session, regime, HTF bias, CVD, and AVWAP.

This AI is the light version of our private Order Flow Ultra.

Download Free: True Liquidity Fund Grade

For the fully automated systems based on cTrader NinjaTrader or our prop system email us- there is a cost involved.

Once this is on your chart, you will never listen to self-proclaimed ICT or Crypto gurus who pump their bags at your expense.

Core logic (how signals happen)

1) Liquidity map (your “battlefield”)

Builds a local volume profile over your lookback.

Extracts:

POC (fairest price / most traded)

VAH/VAL (value area boundaries)

Liquidity shelves = high-activity price bands (thick lines)

2) Execution engine (the “trap and spring”)

A BUY setup requires:

Price is near a shelf

A sell-side sweep (wick below / stop raid) that fails

Displacement candle (impulse) + reclaim above shelf

Optional: MSS confirmation

A SELL is the mirror.

3) Anti-FOMO confirmation (entry hygiene)

Instead of chasing the impulse:

Marks a setup as pending

Waits for pullback/tag near shelf

Requires continuation candle closing beyond shelf

This dramatically reduces “I bought the top of the candle” entries.

4) Break & Hold continuation (trend-friendly)

Separate signal type:

Break through a shelf with displacement

Retest shelf

Hold (close beyond buffer) + continuation

This catches “institutional acceptance” moves.

You won't get many signals- but you get signals like this with visualization of the institutional volume shelves that triggered the signal.

Why it’s fund-grade

This is “fund-grade” because it behaves like a risk desk, not a signal spammer:

Context first, execution second

You’re trading around liquidity shelves, not random indicators.

Regime filter (ER)

Avoids chop where stops get farmed.

Event bar cooldown

Reduces entries during “news-like” volatility bursts.

Session intelligence

Aligns with where liquidity actually hits (London + NY).

HTF bias filter

Stops you from fading higher-timeframe flows.

CVD layer + divergence

Confirms participation / absorption vs. “empty” moves.

HTF Anchored VWAP + bands

Institutional mean / trend anchor to prevent trading against acceptance.

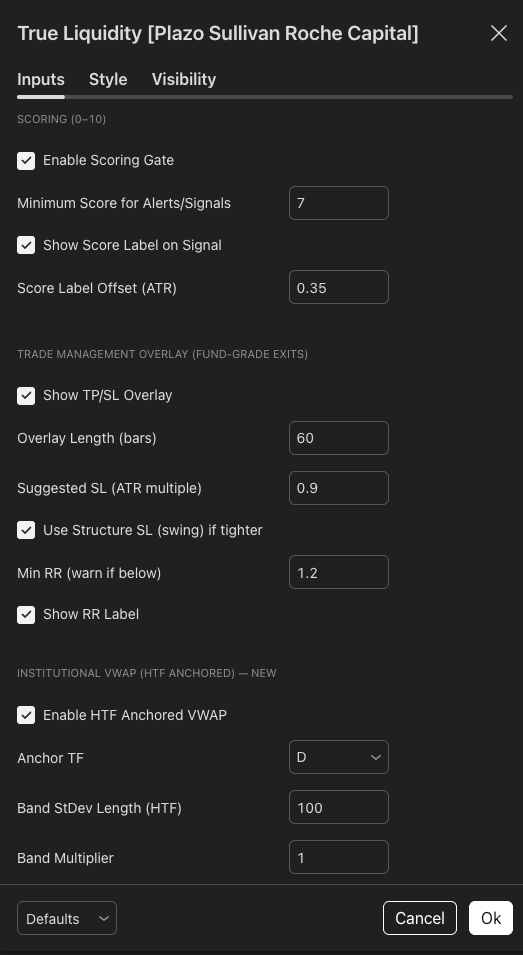

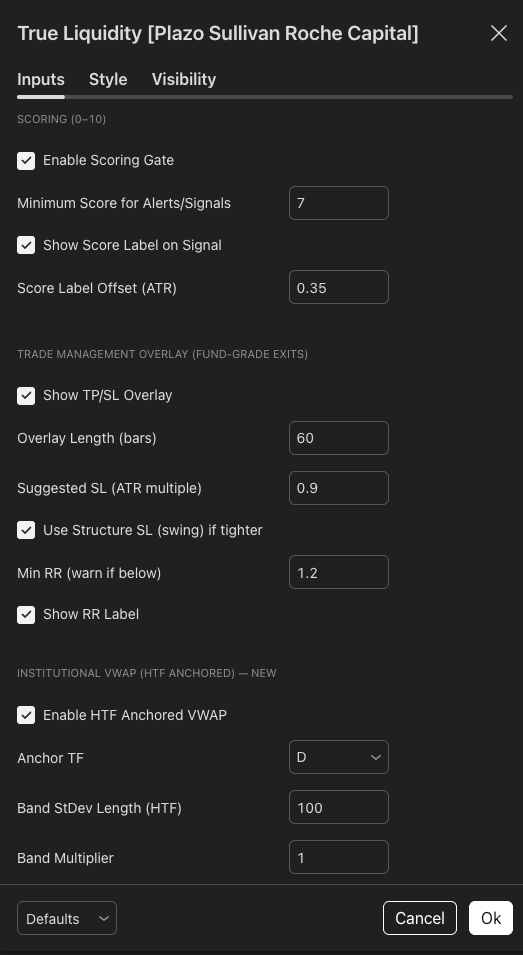

Scoring gate

Forces confluence: shelf strength + proximity + session + bias + delta + regime.

Result: fewer trades, higher quality, better drawdown behavior.

Protections checklist (what blocks trades)

If you’re not getting trades, the HUD “Why blocked” tells you exactly what’s stopping it:

Signals OFF

Chop (ER) / Event cooldown

Outside LDN/NY or Not NY (if NY-only mode)

No Asia Manip (if required)

AVWAP gate

Score gate

Anti-FOMO pending

This is intentional: it’s a safety system.

Best practices (how pros use it)

Setup routine

Pick Mode:

Intraday (London+NY) for most traders

Scalp (NY Only) if you want fewer, cleaner trades

Swing if you’re trading around HTF bias and AVWAP

Let shelves “print” (don’t judge it in the first few bars).

Only act on signals near a shelf (that’s where stops and fills cluster).

Execution rules

Prefer signals that occur:

at strong shelves (thicker / more intense)

with CVD confirmation or divergence

aligned with HTF bias + AVWAP trend mode

If Anti-FOMO is ON: treat “pending” as good news, not delay.

Use the overlay:

SL should sit beyond the raid/swing

First profit is usually POC, then VAH/VAL, then next shelf

Risk management (non-negotiable)

Risk 0.25%–1% per trade.

If RR is flagged weak (RR label), either:

skip it, or

take partials faster (POC) and trail.

Best timeframe

Sweet spot: 5m and 15m (especially for XAUUSD + indices).

1–3m: more noise, needs stricter settings.

30m–1h: fewer signals but strong structure.

Swing mode: 1h–4h with HTF bias ON.

Best assets

Where this shines (deep liquidity + clean raids):

XAUUSD

US100 / NAS100, US30, SPX/US500

EURUSD, GBPUSD

BTC, ETH (best around NY session; keep event filter on)

Avoid / be cautious:

thin minors/exotics (spread + manipulation distort shelves)

dead sessions on indices

Recommended defaults (practical)

Mode: Intraday (London+NY)

Scoring gate: ON (min 7)

Event filter: ON (cooldown 5–6)

Regime filter: ON

CVD: ON (Soft)

AVWAP gate: Trend

Anti-FOMO: ON

Break & Hold: ON

Comments